japan corporate tax rate 2022

Argentinas from 30 to 35 and Gilbratars from 10 to 125. The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy.

Corporate Income Tax Definition Taxedu Tax Foundation

About 5 tax on a 100 purchase.

. It depends on companys scale location amount of taxable income rates of tax and the other. A standard corporate income tax rate is 232 applies to the companies that operate in Japan with a share capital over JPY 100 million. Historical corporate tax rate data.

Corporate Tax Rate. The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident.

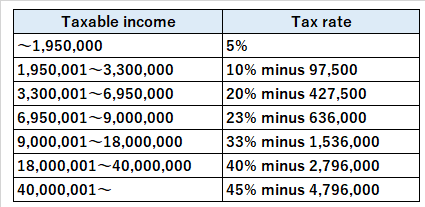

Sales Tax Rate in Japan is expected to reach 1000 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Income Tax Rates and Thresholds Annual Tax Rate. 1993-2021 Data 2022-2024 Perkiraan.

In the case that a corporation amends a tax return and tax liabilities voluntarily. Dividends paid by a Japanese company to another Japanese company are subject to withholding tax at a rate of 2042 even though such withholding taxes are typically fully creditable or refundable for the dividend recipient. The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of JPY100000000 or less or 3062 for companies with paid-in capital greater than JPY100000000 including Japanese branch-offices of foreign companies with paid-in capital greater than JPY100000000.

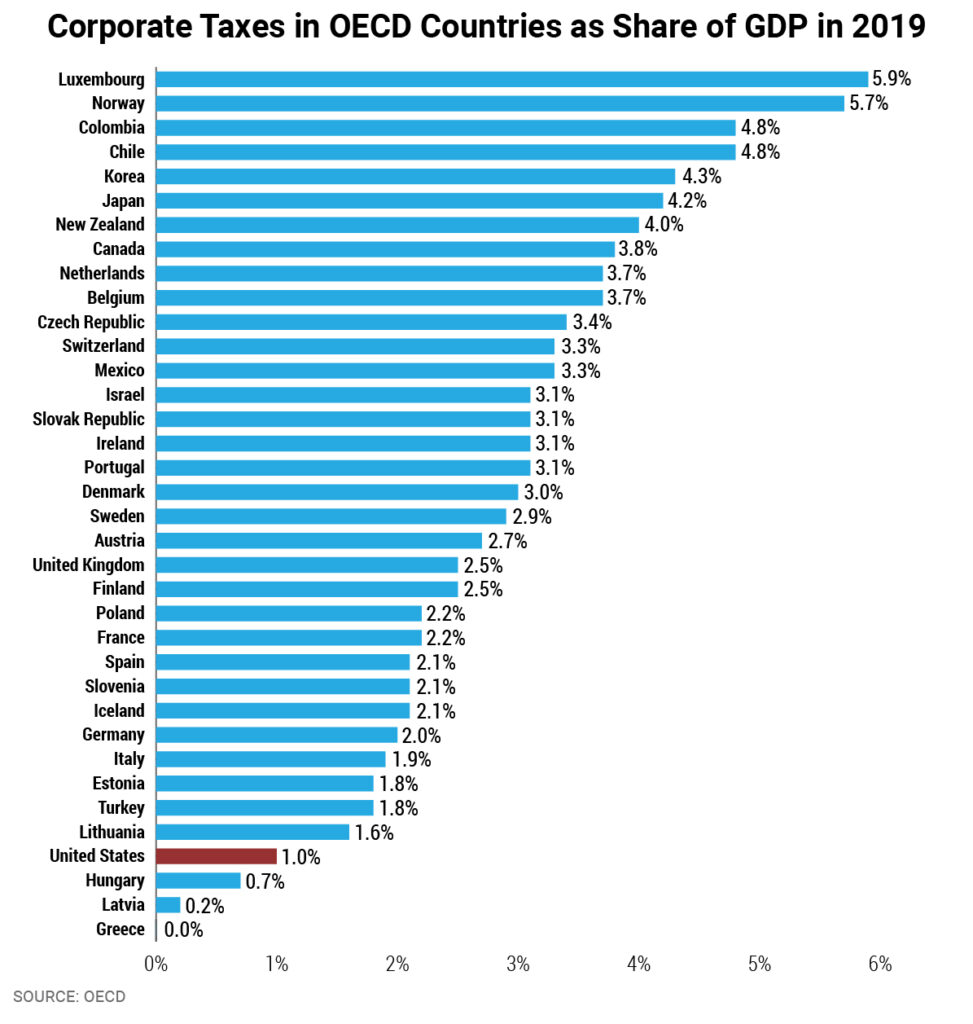

Additionally a local enterprise tax is also levied by the prefecture on corporations. United States Corporate Tax Rate was 21 in 2022. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021.

The rate is increased to 10 to 15 once the tax audit notice is received. In 2021 20 countries changed their statutory corporate income tax rates. 216 rows Corporate Tax Rates in 2021.

Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. The current Japan VAT Value Added Tax is 500. The Outline proposes that if the total compensation paid to specified employees 2 in the current year beginning between 1 April 2022 and 31 March 2024 increases by 3 or more as compared to total compensation paid to specified employees in the previous year the excess of the current years compensation over the previous years compensation is eligible for a 15.

Exact tax amount may vary for different items. Combined Statutory Corporate Income Tax Rate. Japan Sales Tax Rate - Consumption Tax - values historical data and charts - was last updated on April of 2022.

The VAT is a sales tax that applies to the purchase of most goods and services and must be collected and submitted by the merchant to the Japan governmental revenue department. On 22 March 2022 Japans 2022 tax reform bill. A approximately 31 for large companies ie companies with a stated capital of more than 100 million yen.

Three countries increased their corporate tax rates. Local inhabitants tax is levied by both prefectures and municipalities that is payable by the companies. Local management is not required.

Nilai saat ini data historis perkiraan statistik grafik dan kalender ekonomi - Jepang - Tarif Pajak Perusahaan. Capped at 20 of corporate income tax payable. In the long-term the Japan Sales Tax Rate - Consumption Tax is projected to trend around 1000 percent.

KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Japan 0130 BoJ Board Member Suzuki Speaks Forecast. In the United Kingdom the standard statutory corporate income tax rate is due to increase from 19 percent to 25 percent on April 1 2023.

The abolishment of the stamp duty has been decided by the parliament but is subject to a referendum in 2022. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by. And b approximately 35 with a certain favourable rate for up to the first eight.

United States 1300. Data is also available for. An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022.

Bangladesh Argentina and Gibraltar. Bangladesh raised its rate from 25 to 325. 7 rows Japan Income Tax Tables in 2022.

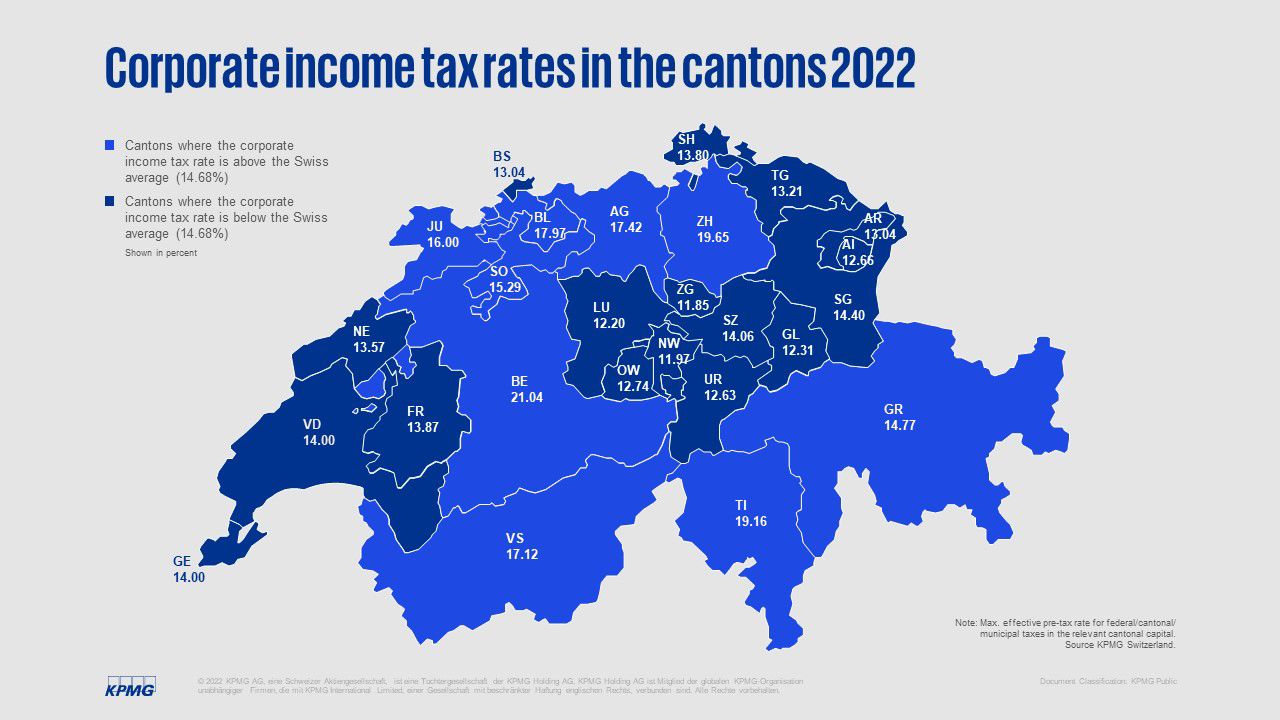

Corporate net wealth tax is imposed at varying rates depending on the canton and the type of tax privilege typically between 0001 and 05. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. An under-payment penalty is imposed at 10 to 15 of additional tax due.

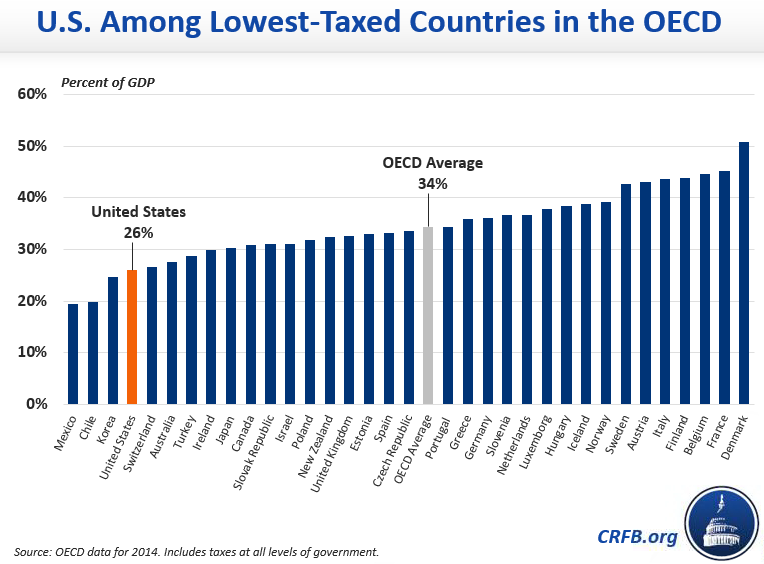

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporation Tax Europe 2021 Statista

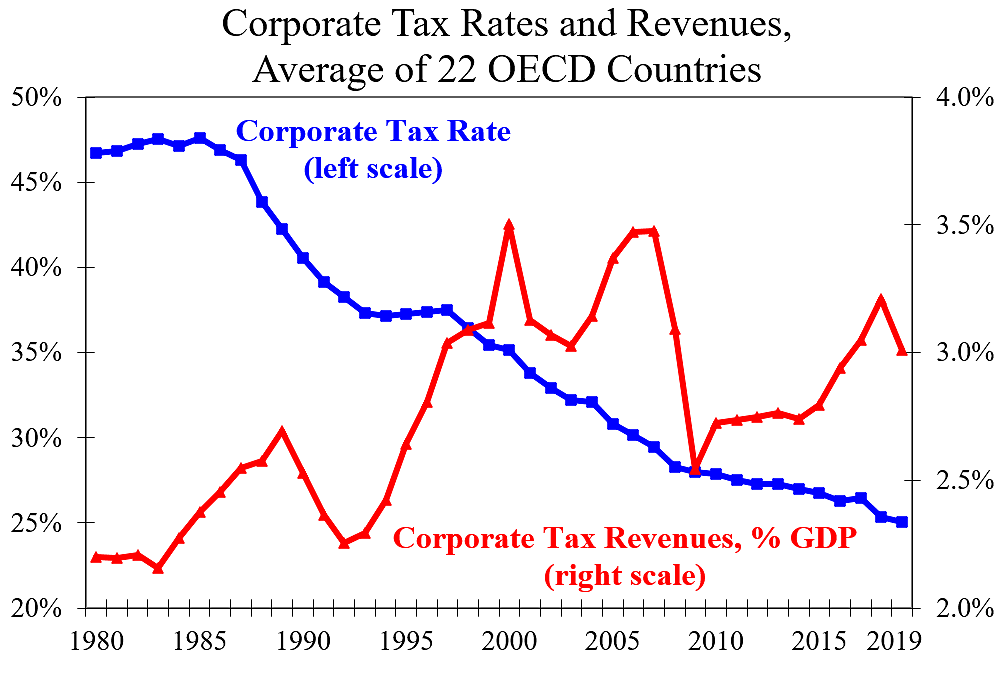

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

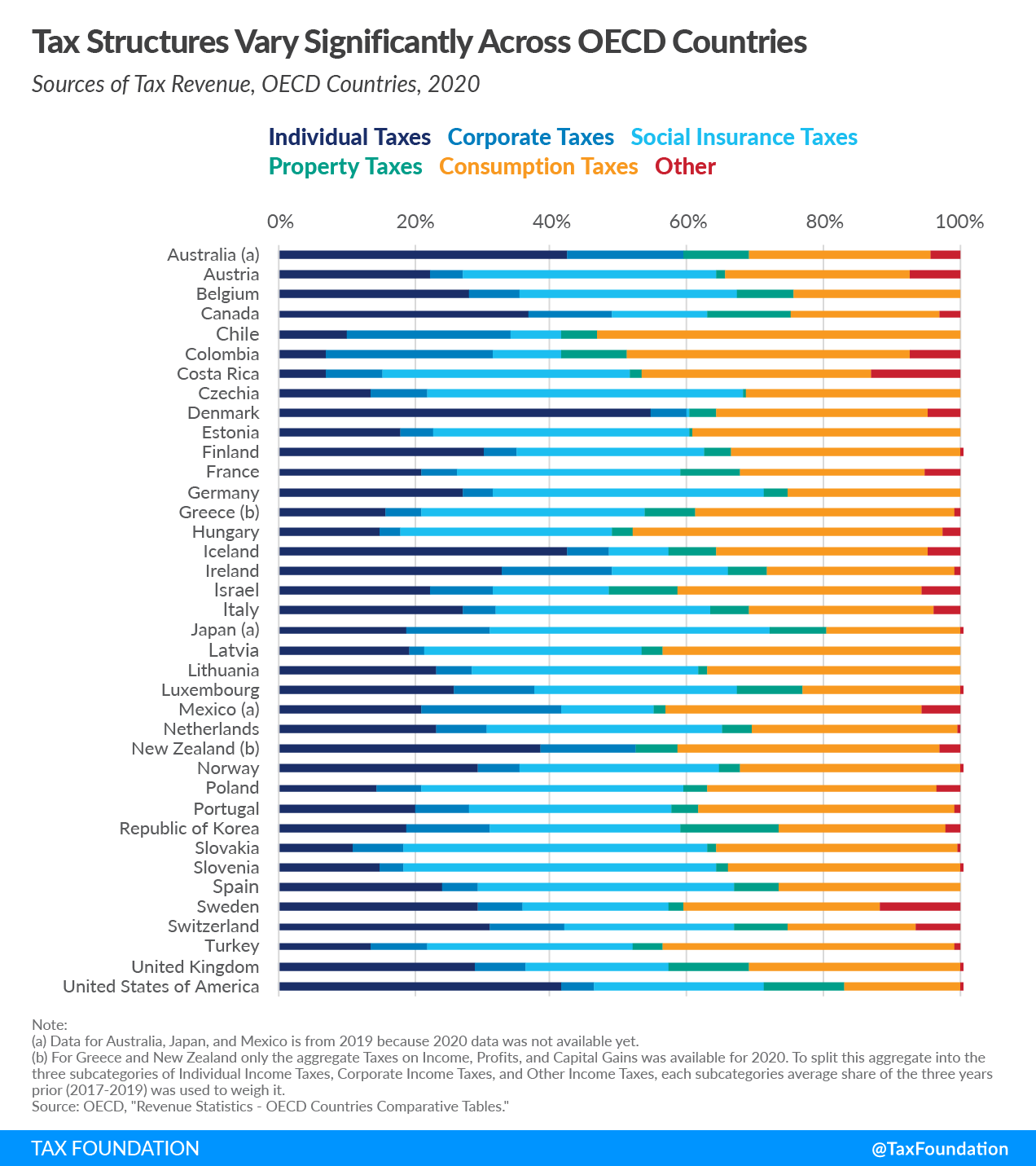

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Income Tax Definition Taxedu Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Tax Reform In The Wake Of The Pandemic Itep

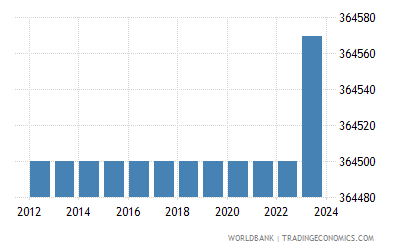

Japan Land Area Sq Km 2022 Data 2023 Forecast 1961 2020 Historical

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Corporate Tax Reform In The Wake Of The Pandemic Itep

Japan Exports Yoy April 2022 Data 1964 2021 Historical May Forecast Calendar

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Corporate Income Tax Cit Rates

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Japan National Debt 2026 Statista

Despite Strong Support For A Global Minimum Corporate Tax U S Legislative Dynamics Could Give Large Multinationals A Reprieve Morning Consult

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates